Top 10 Most Famous Traders In The World Of All Time

A trader is an individual who engages in the buying and selling of financial assets in any financial market, for himself or on behalf of another individual or entity. The main difference between a trader and an investor is the length of time that he or she holds the asset. Investors tend to have longer time horizons, while traders tend to hold assets for short periods of time to capitalize on trends.

Today, Ola City will go back in time to find out the top 10 most famous traders in the world. This list includes celebrities who are traders in many fields. Their lives are colored by both triumphs and tragedies that come with some illustrious feats that have become legends in the financial industry.

I. Top 10 famous traders in the world

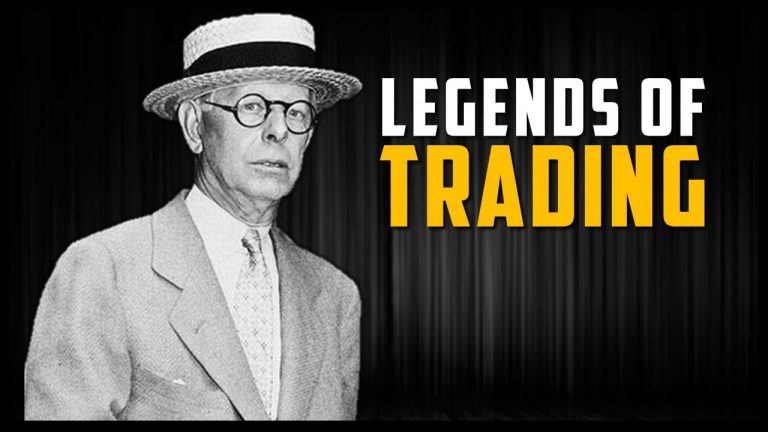

- Jesse Livermore

Jesse Livermore belongs among the greats in trading. Born in 1877, his life saw several great crashes, including the 1929 Wall Street Crash. By that time, he had made around $100 million, the equivalent of billions today, having made and lost other fortunes along the way.

He did this without the aid of price charts or algorithms; instead he kept track of prices in a ledger. He developed the concept of pivot points, which involved watching a stock at key levels to see how it reacted. He would add to successful positions in a manner called ‘pyramiding’, by taking progressively smaller positions in a stock to increase his risk and compound his winnings.

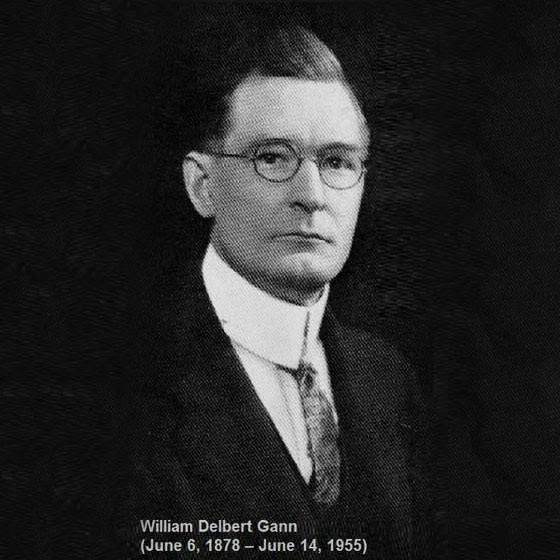

2. William Delbert Gann

WD Gann (1878–1955) William Delbert Gann is perhaps the most mysterious trader in the history of the world. He uses market forecasting methods based on ancient geometry, astrology and mathematics. His mysterious engineering tools include Gann’s angle and the 9th Square.

He believes that everything that happens in the markets has a reference point from history. Basically, everything that happened before will eventually repeat itself. He studied ancient geometry and astrology to study how market events and specific numbers repeat over different periods of time. Besides trading, Gann has also published many books and taught courses.

3. George Soros

Born in 1930, George Soros is one of the most successful forex traders of all time. His bet against the British pound in 1992 reportedly secured $1 billion in profit, earning him the nickname of ‘the man who broke the Bank of England’. He is also a philanthropist, political activist and author.

His most legendary trade was made only days before the British government devalued the pound. Predicting the decision, he leveraged his hedge fund to sell billions of pounds, buying them back at a lower price right after the devaluation. This date became known as Black Wednesday. Soros applied a theory based on the relationship between cause and effect, which helped him get a clear picture of asset bubbles and value discrepancies.

4. Jim Rogers

Jim Rogers is an American investor and financial commentator born in 1942. He and fellow investor George Soros founded the Quantum Fund in the early 1970s. He is most famous for growing the portfolio by 4200% in just 10 years, along with his long positions on commodities in the 1990s. He has been relentlessly bearish on the US market since the early 80s, predicting that more real estate and consumer debt bubbles are going to burst.

5. Richard Dennis

Richard J. Dennis (born 1949) has made his mark in the trading world as a very successful trader based in Chicago. According to reports, he gained a fortune of $200 million within ten years from his speculation. Dennis’s story so far is still able to ignite the fire of passion in traders.

That’s the life of a young man at the age of 23 who turned a $1,600 loan into $200 million after 10 years of trading in commodities. At the age of 26, he was already a millionaire trader.

6. Paul Tudor Jones

Paul Tudor Jones is synonymous with Black Monday – the stock market crash of 1987. He shorted various stocks during this time and made around $100 million. Jones was born in 1954 and he started his career in finance as a clerk on the trading floor. Five years after his famous trade, he was appointed as the chairman of the New York Stock Exchange (NYSE).

Jones attributes his successful trades to his colleague Peter Borish, who mapped the 1987 market against the 1929 market, which also crashed. He shorted a number of stocks due to the similarity between the two sets of circumstances. His investment philosophy is intricate, but his trading style is mostly based on technical analysis.

7. John Paulson

John Paulson was born in 1955 and started his financial pursuits in 1976 when he studied business at New York University. He made his millions when he shorted the real estate market during the stock market crisis of 2007. He bet against mortgage-backed securities by investing in credit default swaps, and made roughly $3.7 billion off these trades – launching him into ‘financial legend’ status. He has a reputation for avoiding the media, and rarely gives interviews.

8. Steven Cohen

Steven Cohen (born 1956) founded SAC Capital Advisors, a leading hedge fund focused primarily on equity trading. Paulson began his career at Boston Consulting Group in 1980 and later moved to New York to work on Wall Street. In 1994, he founded his own hedge fund, Paulson & Co., with $2 million. By 2003, his fund had grown to $300 million in assets.

Paulson became world famous in 2007 when he shorted the US housing market, Paulson’s company did well and he personally made more than $4 billion on this deal alone. In 2013, SAC was charged by the Securities and Exchange Commission with failing to prevent insider trading and later agreed to pay a $1.2 billion fine.

9. David Tepper

David Tepper (born 1957) is the founder of the extremely successful hedge fund Appaloosa Management.

In 2012, Alpha Investments ranked Tepper’s $2.2 billion salary as the highest in the world as a fund manager. He earned third place on Forbes’ list of “The Highest Earning Hedge Fund Managers of 2018” with an annual income of $1.5 billion.

10. Nick Leeson

Nick Leeson (born 1967) is a derivatives trader who caused the collapse of Barings Bank in 1995. Before the scandal, he was heading up the bank’s operations in Singapore, ensuring massive profits through his trades. However, leading up to the collapse, he placed a few bad trades and started to lose huge amounts of money.

Leeson decided to hide the losses from the bank, as an international oversight meant he did not have to report to a supervisor. He tried to win back the capital by placing more and more speculative bets – including a short straddle on the Nikkei. Unfortunately, the index experienced a sharp drop overnight due to the Kobe earthquake and, despite frantic attempts to recoup the losses, Barings Bank lost more than $1 billion. Leeson decided to flee the country, but he was arrested in Germany and faced four years in prison.

II. The bottom line

Above is a list of the world’s most famous top traders who have made a legend in the financial field. The dramatic and varied life stories of the world’s most famous merchants make for compelling material for books and movies. If you want to become a professional trader, start researching and find out now!

Don’t forget to follow Ola City’s Blockchain posts to gain more knowledge of the cryptocurrency market when practicing as an investor.

Best regards,

Ola City Global